Why Should I Think About Investing in Gold and Silver?

By AAA

April 13, 2022

Gold and silver have been valued as money or as highly-prized objects (think “jewelry”) for several centuries. But still, the question posed in the title above is valid. Why should we think about investing in gold and silver, both which seem like valuable relics? After all, we’re in the 21st century. We have cash, digital payment systems, cryptocurrencies, and central bank digital currencies (aka CBDCs) on the horizon.

Aside from jewelry, which still retains a (mostly) symbolic function, what might a hunk of metal or a load of coins bring to the table?

You can’t use it for spending money; it doesn’t seem to exhibit the growth capacity of a stock; and it certainly pays no dividends like investible bonds.

So, what’s it good for?

They’re traditionally recognized as an inflation hedge

This one you probably already know: gold and silver prices are known to rise when inflation erodes purchasing power, (aka, when the cost of goods and services rise across nearly every sector in the economy). Overall, gold and silver have historically performed well not only during periods of inflation, but periods of economic uncertainty and decline as well.

The big caveat here is that precious metals prices don’t always move in lockstep with inflation or any other measure of economic uncertainty. There can be a gap between the rise of inflation and precious metals values.

Why is that the case? Because nobody can tell whether a negative economic condition is going to last or whether other assets might also perform well despite negative conditions. Remember, there’s also a gap between economic fundamentals and market sentiment (aka how investors feel about the economy).

But when times do get tough, and investors finally realize that the tough part might last longer than they had estimated, then gold and silver tend to be among the most-sought “safe haven” assets in the market.

Gold is poised to become a Tier 1 asset

Okay, we get it: the average person on the street probably considers gold a “monetary relic.” It was once considered a form of money, or it once backed money (along with silver), but that was a long time ago. People may still invest in gold and silver, but other assets have stolen the spotlight.

That’s the mainstream talking, and we have nothing against mainstream opinion, except that it’s sometimes wrong. If gold is a monetary relic to the mainstream public, to central banks it’s an active reserve asset. And ever since 2017, when a voluntary group of banking officials called the Basel Committee on Banking Supervision announced that its third Basel III will make gold a Tier 1 asset, central banks began accumulating even more gold for their reserves.

What’s a Tier 1 asset? In the banking world, Tier 1 capital is a bank’s core funding source. The amount of Tier 1 capital a bank has is an indicator of its financial health. Because allocated gold attracts no credit risk and because it can be liquidly traded or converted to other assets, those are among the reasons why gold is likely to become a Tier 1 asset once Basel III rules are fully implemented.

[products limit=”4″ columns=”4″ orderby=”popularity” best_selling=”true” category=”buy-gold” ]

You can keep your assets (and net worth) private

Notice how in that space between you and your money there’s often either a gatekeeper or a toll charge? It isn’t easy to access most of your funds unless someone allows you to access your money or you get dinged a few cents to take hold of what you already own.

Well, if you can’t access your money without someone or something intervening, it just goes without saying that a third-party might also be able to see what you own and what you do with it. In other words, your financial privacy is limited when it comes to assets like cash or traditional investments.

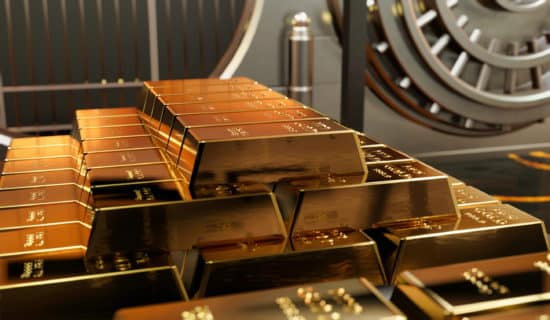

You generally get to avoid all of this by investing in physical gold and silver (emphasis on “physical”). By storing physical bullion coins or bars in a safe or in a depository, your assets remain a lot more private than most other traditional assets. Best of all, and if it matters to you, you can remain discrete without anyone else knowing your actual net worth.

Gold is universally recognized as money (and silver too)

Let’s do a mental experiment. As unfathomable as it may seem, let’s suppose the entire “fiat currency” system collapses. Fiat currency, which happens to be the currency system underpinning the entire global economy, is money that’s decreed “legal tender” but not backed by any tangible commodity.

Back to our hypothetical experiment: fiat goes “kaput.” Now what? What other form of money do people use that’s universally recognizable as money? Here’s a better way to go about the question: what do banks hold in reserve that’s not tied to fiat system values?

If you answered “gold,” then you’re correct. Gold is universally recognized as a “monetary metal.” Technically, you can go anywhere in the world and gold will likely be accepted as a monetary asset.

Although silver has been largely demonetized by central banks, silver has historically backed money (and it has been used as money). This means we can all assume silver is number two to gold’s monetary status. But still, there are other reasons why silver is a unique asset to hold, considering that it’s a hybrid monetary-industrial metal.

The Takeaway

These are just a few of the reasons why you might want to consider diversifying in gold and silver. To understand the rationale behind gold and silver investments, you might want to learn more about the characteristics of each metal, particularly silver, which is a monetary-industrial hybrid. More on that here.

[products limit=”4″ columns=”4″ orderby=”popularity” best_selling=”true” category=”buy-gold” ]